Wake County Property Tax Rate 2024 Percentage Calculator

- admin

- 0

- on

Wake County Property Tax Rate 2024 Percentage Calculator – Wake County’s 2024 revaluation, the process of updating real property values to reflect fair market value as of Jan. 1, shows an overall increase of 53 percent tax bill, as North Carolina counties . You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 .

Wake County Property Tax Rate 2024 Percentage Calculator

Source : www.wake.gov

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

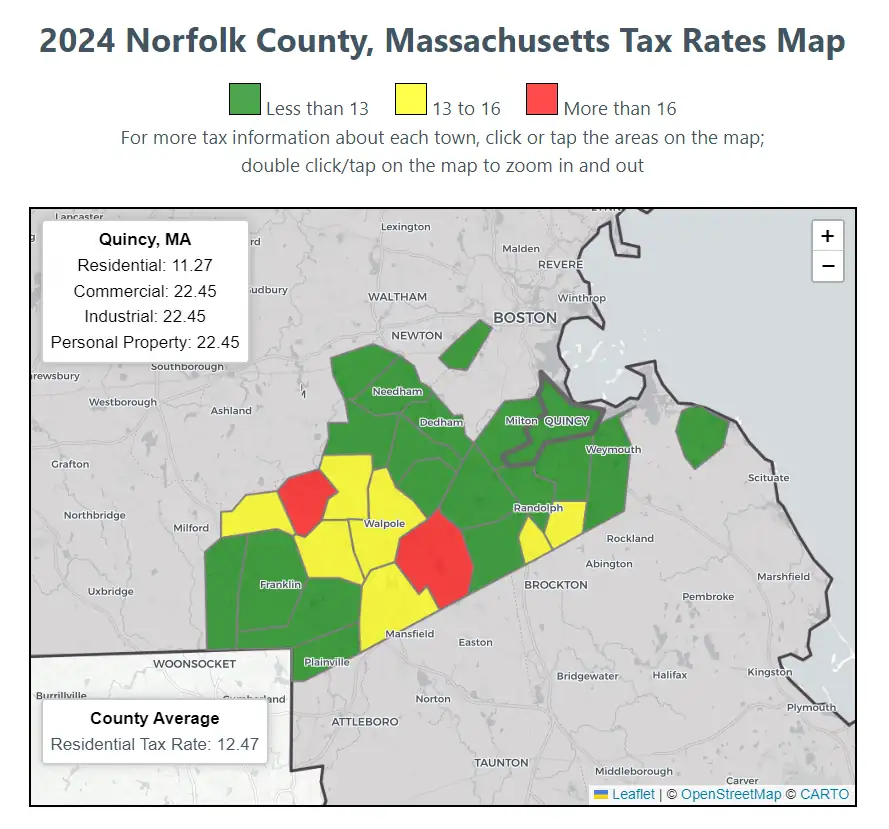

2024 Norfolk County Massachusetts Property Tax Rates | Residential

Source : joeshimkus.com

Schedule of Values | Wake County Government

Source : www.wake.gov

How To Charge Sales Tax in the US (2024) Shopify USA

Source : www.shopify.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Wake County revaluation results: home, commercial values soar

Source : www.newsobserver.com

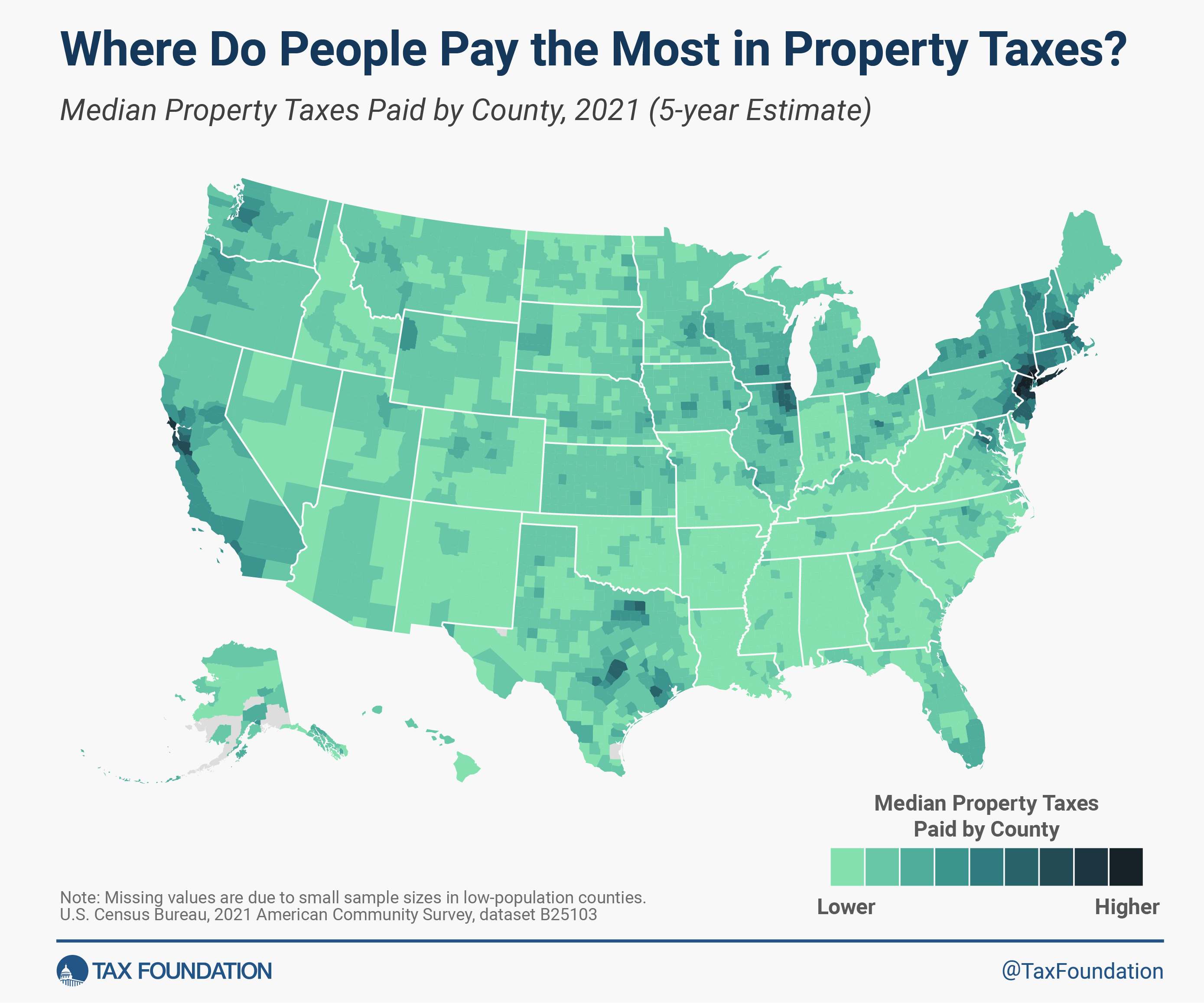

Property Taxes by State & County: Median Property Tax Bills

Source : taxfoundation.org

1 Wake County Public School System Superintendent’s Proposed

Source : www.wcpss.net

Wake County Property Tax Rate 2024 Percentage Calculator New property value notices to hit Wake County mailboxes starting : Wake County is estimating it will raise $1.4 billion in property taxes in fiscal year 2025, which runs from July 1, 2024 – June 30, 2025. Property tax is Wake County’s largest revenue source . While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills .